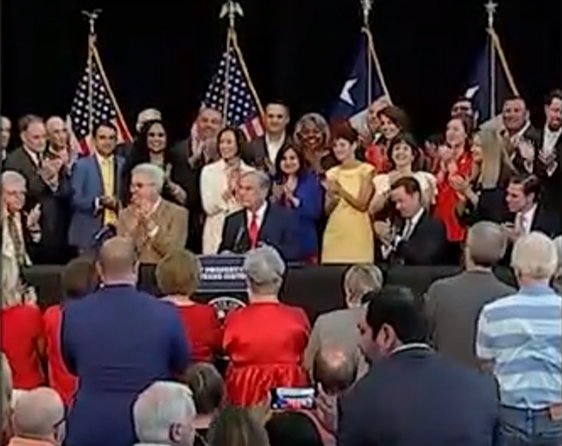

NEW CANEY (WBAP/KLIF News ) – Governor Greg Abbott ceremonially signed an $18 billion property tax relief package in New Caney on Wednesday, it’s the largest cut in state history.

He was joined by Lieutenant Governor Dan Patrick, Speaker Dade Phelan, Senator Paul Bettencourt, Representative Morgan Meyer, and other members of the Texas Legislature.

Speaking to a crowd of supporters, the Governor reminding Texans that he initially promised $15 billion in relief and thanked state lawmakers.

“Because of the work put in by Lt. Governor Patrick, Speaker Phelan and members of the Texas legislature, they were able to even more. The laws I am about to sign provide for $18 billion,” he said.

A key component of the package is Senate Bill 2 authored by Senator Paul Bettencourt (R-Houston), which increases the homestead exemption for 5.72 million homeowners and provides relief to small businesses and seniors.

“School property taxes will be slashed. Your homestead exemption will rise to $100,000,” said Governor Abbott. The package also puts a first-ever 20% cap on appraisal increases on properties valued at $5 million or lower that aren’t considered homesteads.

Governor Abbott made cutting property taxes an emergency item for the 88th Texas Legislature, resulting in the passing of Senate Bill 2 and Senate Bill 3.

Senate Bill 2 provides property tax relief through tax rate compression, an increase in the homestead exemption and a pilot projecting limiting the growth in appraised values. For the tax year 2023, lawmakers said this will save the average Texas homestead owner over $1,200. Homestead owners over 65 or with a disability will see over $1,400 in savings.

Senate Bill 3 increases the Franchise Tax “no tax due” threshold to $2.47 million and removes burdensome filing requirements for those who do not owe tax.

Abbott initially signed the package in July.

Each piece of legislation in the package must be approved by voters in November 7.

Copyright 2023. WBAP/KLIF News. All Rights Reserved.