WASHINGTON (AP) — Facing growing pressure to show progress in their investigations, House Republicans on Wednesday plan to detail what they say are concerning new findings about President Joe Biden’s family and their finances.

The smoking gun, according to the GOP, is “thousands of pages” of recently obtained financial records that include more than 150 suspicious activity reports connected to the president’s son Hunter Biden and brother James Biden, as well as a growing number of associates.

The confidential reports, called SARs for short, are often routine, with larger financial transactions automatically flagged to the government. The filing of a SARs report is not evidence on its own of misconduct.

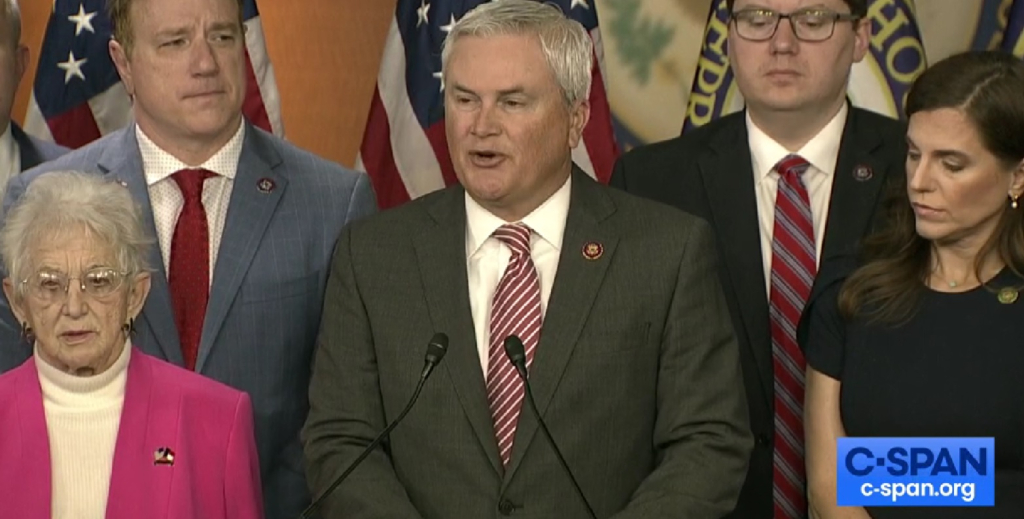

But Republicans in Congress, notably Rep. James Comer, the chairman of the House Oversight Committee leading the probe, believe the records could potentially show an effort by the president and his family to trade off his name.

The White House has continuously dismissed the investigation as “yet another political stunt.”

“Congressman Comer has a history of playing fast and loose with the facts and spreading baseless innuendo while refusing to conduct his so-called ‘investigations’ with legitimacy,” White House spokesperson Ian Sams said in a statement.

Here’s a deeper look at suspicious activity reports and how Republicans are using them as a roadmap to investigate the Biden family.

Full press conference:

https://www.c-span.org/video/?527960-1/house-oversight-cmte-chair-james-comer-holds-news-conference-hunter-biden-investigationFinancial institutions are required to file a suspicious activity report to the Financial Crimes Enforcement Network (FinCEN) no later than 30 calendar days from when it detects a suspicious transaction that could have links to money laundering or terrorism financing.

First originated as a “criminal referral form,” suspicious activity reports were established through the 1970 Bank Secrecy Act. In 1996, according to FinCEN, the form became the standard way to report suspicious activity in the financial system.

The rules around the reports were later amended under the U.S. Patriot Act. Today, banks and credit unions routinely submit SARs.

(Associated Press)